So what are you waiting for? I know you hear is all the time, but this year REALLY is a great time to sell!

From the category archives:

Buyers

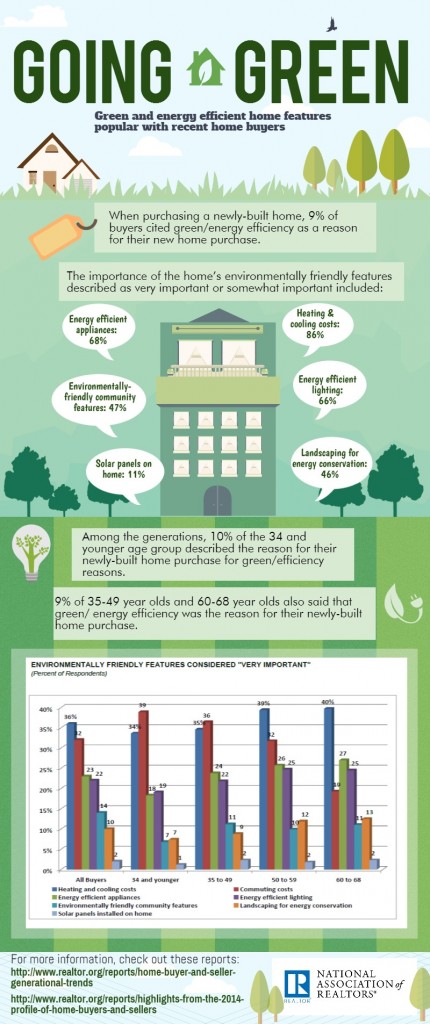

The National Association has just released some statistics about how green home features are affecting buyers decisions when purchasing a home. While commuting costs are a big concern for younger buyers, energy heating and cooling costs are the number one concern as buyers get older. Even though the data paints a broad stroke over the entire nation, it is safe to say that commuting and energy costs rank high in Minnesota, too. Local builders are taking building “green” into account, some becoming GreenStar certified.

Looking to buy a luxury home in Minneapolis, St. Paul, Lake Minnetonka, or the Twin Cities metro area? Here are more ideas on what to do before your next home purchase:

Looking to buy a luxury home in Minneapolis, St. Paul, Lake Minnetonka, or the Twin Cities metro area? Here are more ideas on what to do before your next home purchase:

- Look beyond your Target Price – You might be looking for a home in the $5 million range, but if you are looking in an area other than where you currently live, you need to find an experienced luxury agent to help you understand market value. Find out what $1 Million, 3 Million, or even $10 million will get you.

- Don’t Get Sticker Shock – Prime locations command prime dollars. Expect to pay higher than normal prices for waterfront properties, mountain views, and prestigious areas.

- Communication is Key – real estate agents cannot read your mind, no matter how good they are. It is extremely important to be honest about your goals and your finances in order to have a great experience. Most luxury agents understand the need for confidentiality and will be more than happy to work with you.

- Put Trust in Your Agent – Realtors are professionals, so trust that your agent understands what you want (again, communicate) and you’ll be viewing homes that meet your needs. If at anytime you feel uncomfortable, do not feel guilty for seeking out a new agent.

- Don’t be Confidential about your Assets – Be prepared to show your ability to purchase, no matter who you are. You might be well known where you live, but your new city banker won’t. Have your bankers talk to each other to verify there are funds available to close and to also source the origination of those funds. The seller might also ask for a letter of verification from your lender for their peace of mind.

- Don’t forget Future Resale Value – It might not be your top priority, but someday you will probably want to sell the home you are purchasing. Check the appreciation rate for the neighborhood and take it into consideration when buying.

- Think about your Offer – Price is usually the first item a seller looks at when an offer is written on their home, but an offer can also consist of contingencies about inspections, finances, closing dates etc. Remember to make your offer based on of all terms and the condition of the home. If need be, have your Realtor write up an explanation of your offer terms to include with the contract. Sometimes explaining your situation or reason to the seller will give you a “human factor” and most times get your offer accepted.

- Don’t get Emotional about the Seller’s Personal Property – if there is something you like in their home and would like to ask for it, do not write it in the contract. Instead, draw up a separate agreement and ask nicely for the item(s). If they say no, let it go. Too many deals fall through because of household appliances or a chandelier. If they promise something is in included, get it in writing!

- Get to know the Paper Work – Ask your agent for copies of all documents and disclosures and review them before you make an offer. Mark any areas where you have questions. Every state is different regarding the types of disclosures you need, and what you are use to in one state, most likely will differ in another. For example, in Florida, there is a “Termite” Disclosure which also covers mold, wood rot, and powder post beetles, but if you want to buy in Minnesota, they have no such disclosure.

I hate to say it is funny, but the reaction I get from people each time I ask this question has become so common that I have to smile each time it happens. The magical question is “Are you currently working with a Realtor?” There is usually a short pause as the home owner or potential buyer processes the question, with expressions that range from the obvious “No”, to “What does it matter to you”. I usually ask this question when someone calls to inquire about a property, or to set up a meeting to market their home. Most don’t realize the importance of the question, but as a Realtor, it is extremely important for me to know up front if you are working with another Realtor.

By “working with another Realtor”, what I am really asking is if you are under written contract with another Broker – meaning they represent your interests and owe you fiduciary duties. See, Realtors are bound by the Code of Ethics set by the National Association of Realtors, and according to Standard of Practice Article 16:

REALTORS® shall not engage in any practice or take any action inconsistent with exclusive representation or exclusive brokerage relationship agreements that other REALTORS® have with clients.

We also have an “obligation to make reasonable efforts to determine whether the prospect is subject to a current, valid exclusive agreement to provide the same type of real estate service”.

I take the Code of Ethics very seriously and the last thing I want to do is step on another agent’s shoes, or violate the Code of Ethics. Many times I hear from people that they have been working with another agent, but do not have a written Representation Agreement with them. (Some think working with multiple agents helps them with their home search, but it doesn’t). Others have written agreements expiring and are looking for a new agent to represent them. Some are looking for advice, and depending on their answer, I will or will not give them any.

So, next time your hear this question, be honest. Explain to the agent why you are calling, and let her know right away if you are/aren’t working with anyone.

Looking to purchase a new luxury home this year in the Twin Cities? Most likely, you will be using what’s called a Jumbo Loan to help finance the purchase.

What you need to know is that the rules have changed, thanks to the Consumer Financial Protection Bureau. Effective January 10, 2014, the rules for the jumbo-mortgage market are changing. According to the Wall Street Journal’s Market Watch, here are five changes to expect in 2014:

- Fewer types of Jumbo Loans – interest only loans and those with balloon payments will be hard to find, and will most likely result in a higher down payment requirement.

- Lower Down Payments – the good news is that many banks are dropping the 20% down requirement on large loans, some down to 10-15%. But this might mean private mortgage insurance will come back, an added expense for borrowers.

- New Rules for “non-qualified” loans – Loans that meet the new “qualified” requirements must have no higher than a 43% debt to income ratio. For banks wishing to offer jumbo loans above this mark, they will most likely require higher down payments, and proof of large cash reserves.

- Banks will Push for ARMs – rates on 30 year fixed-rate Jumbo Loans will increase over time, thus causing some banks to promote ARMs (adjustable rate mortgages), allowing them to make more money on higher interest rates once a borrower’s rates reset

- Rate Changes – new rules created by Dodd-Frank will cause investors to pay more for loans sold to them, passing this cost down to borrowers utilizing Jumbo Loans

The video below is a quick snapshot about how the new Mortgage rules will affect the real estate industry this year.

Here are some good suggestions on what to do before you purchase a home.

Here are some good suggestions on what to do before you purchase a home.

- Look for Lenders that cater to the affluent – A buyer looking as a $4 Million home doesn’t go to Lending Tree for a loan. You need a mortgage company with a history of upper bracket real estate.

- Shop on the Internet, but don’t look at a home without a Realtor – The Internet is real estate’s most versatile tool and is a great way to browse for luxury homes and narrow down your choices. Look for a real estate agent that specializes in upper bracket homes and be honest with them about your purchasing power.

- If you call on a listing, talk to the Listing Agent of the property – The best number to call is the agent’s cell phone, or better yet, email them. If you do have to call the office, leave a message for the listing agent. Often buyers who call about a home will only get the floor duty agent, who is always new.

- Use an Agent that is an expert in the market and works the Luxury listings – Great agents are great agents, but if they don’t work specifically in your target price range in your target location they will not be as valuable a resource an agent who does.

- Special properties need special agents – Ranches, waterfront, equestrian estates, all require specialized knowledge. Buyers will not know the zoning laws and potential problems associated with specialty properties, but your agent working in that arena will. An agent who does not normally work with Luxury homes could be a liability to you.

- Know who handles the closing – How homes are bought and sold varies by state, county and region. Attorneys might handle the sale in some states and a title company in others.

- Get an Estimate on Closing Costs – Closing costs vary by state. You also need to know if property taxes are prorated and if the state levies taxes off the purchase price or mortgage. These can be pricey when buying an expensive home.

- Ask Questions about the local Luxury Market – Get to know the purchase documents before hand and it will help you make a better offer. Good agents educate you about the market, what is selling or not selling, and guide you through the buying process. Remember, there are no dumb questions!

Look for my next two installments of this series in the upcoming weeks!

In the life of a real estate agent, most transactions happen without incident. A seller and buyer come together, discuss terms, and viol`a, a house is sold. (OK, it isn’t exactly as easy as that.) But every now and then there comes a time when less than pleasant incidents occur, and I am reminded that life continues on through it all.

In the life of a real estate agent, most transactions happen without incident. A seller and buyer come together, discuss terms, and viol`a, a house is sold. (OK, it isn’t exactly as easy as that.) But every now and then there comes a time when less than pleasant incidents occur, and I am reminded that life continues on through it all.

It has taken a couple of months to write about this as it greatly troubled me at the time it happened. Those who know me, including clients, know my motto is: “All things happen for a reason”. It has always been my belief that we are guided along through our lives, and that each decision we make helps shape our future. Those decisions affect those around us, no matter how minute.

I had a wonderful home listed – old, with a wrap around porch. It was waiting for that one special person who would fall in love with it and bring it back to life. Eventually, we found that buyer. Unfortunately, at the same time they presented their offer, another one came in at the exact same price and terms. Enter negotiations.

As often happens with multiple offers, I had to respond to both buyers asking them to resubmit their highest and best offer. As fortune would have it, the buyer that wanted to restore the home came in with the best offer. I knew both parties were anxiously waiting my phone call, so after the seller informed me of his decision on the “winner”, I immediately called the buyer’s agent to give the good news. To say he was ecstatic is an understatement – I was told how much his clients loved this home and how they were going to restore it to its former glory, and it made me really happy to know I was going to a part of a transaction that was about more than just a house. Having restored old homes in the past, I knew what kind of people these buyers were – passionate and loving.

The seller was out of town until the next day so we had to wait for final signatures before the deal was officially “done”. I spent the evening with my family, happy that this home was going to be loved again. When the phone rang late that evening, I answered it, which is not something I usually do. The person on the other end was the buyer’s agent, and he was clearly upset. Thoughts quickly went through my head – his clients had decided to pull out, they wanted to change the terms, etc., but what he preceded to tell me had me in utter shock.

Immediately after we spoke earlier that afternoon, he called his clients to give them the good news. The buyers were so excited. They were so excited that Mr. Buyer decided to immediately ride over to the home to sit on the wrap around porch and dream about “his house”. What happened next seems only to happen in movies. On the way to the home, riding his motorcycle, traffic stopped suddenly. He was able to stop in time, but the driver behind him, who was not paying attention, didn’t. Mr. Buyer was hit, and even though he was wearing a helmet, was killed from the crash. The buyer’s agent was calling me from the hospital, as he was a good friend of the buyers and their family. After he finished telling me that Mrs. Buyer would have to pull their offer due to the accident, I told him I understood completely and would inform the seller that night. After I hung up, still stunned, my tears started flowing. I called the seller, and between sobs, told him what had happened. Needless to say, he was also in utter shock.

As I said before, I believe everything happens for a reason, even if it is bad. I don’t know what the grand plan of life is, or why this happened, but what it does reaffirm is how much each decision we make, no matter how minute, can affect the lives around us. While I know I should not feel guilty about his death, apart of me wonders if the buyer would still be alive had I waited five more minutes before calling his agent. Can life’s path really be changed so quickly? My husband and family tell me it was not my fault, that is was meant to be. I know they are right. But through my eyes, it’s hard to understand how one simple phone call, that brought so much joy one minute, later caused so much heartbreak. You could go crazy trying to wrap your head around it.

So often I hear people dismiss real estate agents as vultures, only caring about making a “quick” commission. They just don’t get it. We are so much more, and it takes a special kind of person to juggle the many hats real estate agents wear. In this case, I became a grief counselor, not only for my client, but for myself. I felt connected to the buyers through their love, excitement, and passion about restoring an old home. A house was bringing us all together.

So see, real estate isn’t just about a house, it’s about people. And even though we don’t realize it, we are all connected.

I think the answer to this post on comparing Market Value vs. Assessed Value can be summed up in four simple words, “Just Don’t Do It“. In the past few months I have seen an increased objection voiced by some buyers over home prices. When I ask them to justify their reasoning, I am quickly told something along the lines of “Well, the home is only assessed for X. Why should I pay more than that?”

To make it simple, Market Value in Minnesota is what a buyer is willing to pay for a home, where Assessed Value is a valued placed on a property by a governemnt tax assessor for the purposes of taxation. The two are not the same. Every state is different in how they calculate property assessments, and Minnesota uses a system that is different from any state I have lived in.

Take for instance Dakota County.The current 2011 tax statements that were sent out this year are not based on current home prices. Instead, they are taken from home sales that occured between Oct. 1, 2009 and Sept. 30, 2010, data that no home appraiser would be able to use under financial guidelines as the sales are too far into the past. So if I were to buy a home towards the end of 2011, the “values” used by the county assessor could be off by two years!

Now look at homes currently for sale on the open market. The most important job of a real estate agent is determining what the Fair Market Value of a property is by comparing it to other properties that have recently sold in the area. This “market snapshot” is a more accurate, not to mention more up-to-date, representation of a home’s value. If buyer’s are willing to pay “X” for a similar home down the street, then there is a good chance another buyer is willing to pay around the same amount for your home.

While homes that are priced in lower tax brackets tend to show assessed values and market values closer together, homes in the upper-bracket real estate market, especially waterfront properties and historic homes, tend to be further apart when comparing the two values. County tax assessors generally have poor to no knowledge of what the true value of an expensive home might be, as they rarely have direct access to the interior of homes. Take for instance a large historic home I sold in Minneapolis. It was a truly unique home with nothing remotely like it on that side of town. The historic elements inside the home were priceless and would be near impossible to duplicate, but according to the tax assessor, the home was assessed well below its true market value. When a buyer did come in with an offer, they had it priced at the assessed value. I literally laughed when I saw the exact number and had to do the buyer’s agent’s job for her by showing where proper comparable home’s would come from (she was an out of town agent). After some negotiating, the seller and buyer were able to come to an agreed to price, which was up considerably from the assessed value first proposed by the buyer.

So please, when you are shopping for a home, do not use the assessed value of a home as the basis for an offer. Instead, look at what other comparable homes in the area have sold for and go from there!

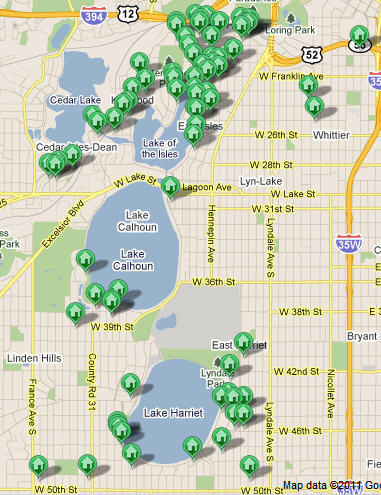

So you’ve decided that your next home will be in Minneapolis and now you have to find somewhere to live. Minneapolis is a pretty big city, so where do you begin? While the task might seem daunting, luxury homes in Minneapolis are quite easy to find as most of them are located in the Chain of Lakes region southwest of downtown, as seen in the listing snapshot showing current luxury homes for sale in Minneapolis.

Probably the most important decision to make is how much you want to spend on your new home as it will determine on which lake you can afford to buy and of course how close to one of the lakes you can live. The most expensive and prominent area of the Chain of Lakes is around Lake of the Isles and just northeast of this area – calledLowry Hill. Some of the premier mansions were built in this area by prominent architects and are in wonderful condition. Others are in need of repair and updating so you will want to take that into consideration as well, but no matter what condition they are in, prices for these homes can range from $2 Million- $7 Million.

Surrounding Lake Calhoun and Lake Harrietare old historic and luxury homes nestled along beautiful landscaped streets that are a little more affordable when compared to Lake of the Isles – by affordable, prices start at $800,000 and go up to $2 Million. No homes sit directly on the lakeshore, but are located starting a block away. One of the biggest draws to the area are the trails surrounding the lakes, which accommodate cyclists, joggers, walkers, and rollerbladers.

Now that you have thought about the price tag of your new Minneapolis luxury home, it’s time to drive around the area and see which lake you like the best. While all three are close together, each lake along the Chain of Lakes as its own atmosphere. Lake Calhoun has a younger vibe, with families and young entrepreneurs, not to mention the close proximity to Uptown which features shops, restaurants, and a local bar scene. Lake of the Isles has a more upscale feel with the more expensive homes, featuring neighborhoods that twist and turn along winding streets and a hilly landscape. The southern most lake, Lake Harriet, is more structured with cottage style homes and gardens, not to mention a fantastic park on the northern shore. Residents can enjoy concerts at the bandstand, ride the trolley, or enjoy swimming or boating on the lake.

Purchasing a luxury home in Minneapolis is a big decision, but one that can easily be helped by talking to a real estate agent. Many times I find that the home is what buyer’s fall in love with, not necessarily the lake it sits near. If you are ready to start shopping, you can begin your real estate search here, or give me a call – I’d love to help!

Probably one of the last things a luxury buyer thinks about when shopping for a new home is how he is going to insure it and how much is it going to cost. One of the hardest things to figure out is WHO is going to insure it. Luxury homes are not insured by every insurance company out there, and most likely, buyers will have to choose from a small pool of companies.

Probably one of the last things a luxury buyer thinks about when shopping for a new home is how he is going to insure it and how much is it going to cost. One of the hardest things to figure out is WHO is going to insure it. Luxury homes are not insured by every insurance company out there, and most likely, buyers will have to choose from a small pool of companies.

For instance, Minneapolis and St. Paul have an extensive inventory of historic homes with many showcasing architectural elements that would cost a fortune to reproduce today. Sorry, but Allstate just won’t do. Buyers and home owners can’t just pick any insurance company to cover these beautiful and rare items; therefore, the best way to protect your home is to choose an insurance company that has a specific policy covering old homes. Placing a value on items can be tricky, so agents can come to your home and evaluate original stain glass windows, rare woodwork, imported tile, expensive wall coverings, stone carvings…you name it, they have the expertise to value your home’s special attributes.

The initial appraisal and inventory of your home is crucial. Agents will take photos and detailed notes of everything in your home, so that should a disaster strike, your home can be reconstructed as best as possible to its original state. Most of these special insurance companies will go above and beyond the policy to make sure your home is returned to you better than before, even updating your home to current code at no additional expense to the home owner.

Some companies that you might look into for insuring your luxury home include:

- HUB International – can quote from the Top 5 upscale insurance companies

- Fireman’s Fund

- Chubb

- AIG/Chartis

- ACE

- PURE

Many of these companies offer increased coverage for Wine Collections, Jewelry, multiple properties, flood insurance, Kidnap and Ransom, Fine Art, etc.

Home Owners, you aren’t left out of this conversation either.

Over the years, million dollar mansions are updated and improved, but many homeowners neglect to call up their insurer and inform them of the improvements, leaving their home undervalued. When disaster strikes, homeowners could find themselves in a tough place when they don’t get the correct dollar value to replace their home and personal items. It is suggested that homeowners update their policy every year to make sure they are fully covered.

And don’t let the declining real estate market, which might state the value of your home has decreased, affect the insured value of your home. Home values have little to do with how much it will cost to rebuild and replace everything lost, so don’t get caught in that trap.