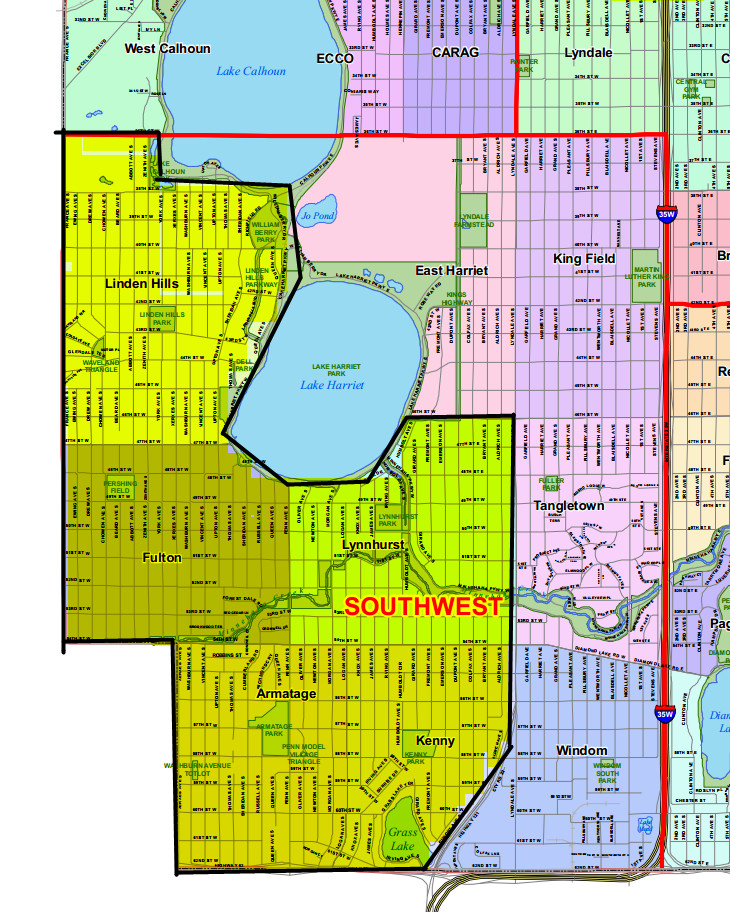

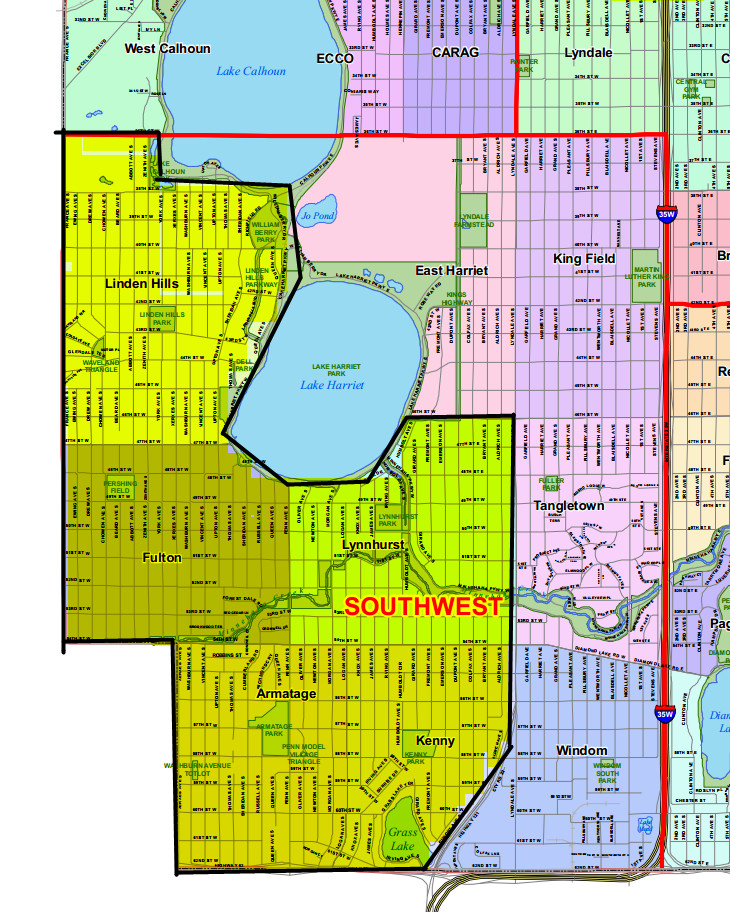

On Friday, March 7, 2014, the Minneapolis City Council voted 13-0 to immediately enact a moratorium on residential redevelopment in the Armatage, Fulton, Kenny, Linden Hills, and Lynnhurst neighborhoods. This action was brought by newly elected Ward 13 Councilmember Linea Palmisano, and will last for ONE YEAR!

Highlighted Neighborhoods of Minneapolis Moratorium

This means if you are looking for new construction in these neighborhoods, you can’t build. If you want to sell your home to a developer as a tear down, you can’t because the developer won’t buy it. If you were thinking of adding on an addition to your home, you can’t do it unless the total above ground square footage is less than 1500. Oh, and if you are having a hardship, you have to appeal to the City Council and prove your hardship…if it isn’t good enough for the council, than you will be denied!

Is this stupid??? Ummm, YES!

The official council motion reads:

Motion by Palmisano to introduce an ordinance amending Title 21 of the Minneapolis Code of Ordinances relating to Interim Ordinances, for first reading and referral to the Zoning & Planning Committee (adding a new Chapter 590 providing for a moratorium on the demolition, new construction, or establishment of single and two-family residential dwellings in the R1, R1A, R2, and R2B zoning districts in neighborhoods of Linden Hills, Fulton, Armatage, Kenny, and Lynnhurst, and authorizing the department of Community Planning and Economic Development to conduct a study to inform future development of the area and to propose such amendments to the city’s official controls and other regulatory devices)

The full text of the ordinance can be found here.

Due to the invocation of the city’s Zoning Code Chapter 529, the council was able to make this ordinance effective immediately upon passage.

According to the Minneapolis Association of Realtors, “neither the housing industry nor the public was invited to engage with the city on any issues of concern leading up to this moratorium vote. We are very disappointed that the City moved to put a yearlong ban on housing in these critical Minneapolis neighborhoods. The disregard for constituents, both current and future, saddens and dismays all of us in the housing community. This moratorium will be incredibly damaging the overall housing market, and especially to the property rights of Armatage, Fulton, Kenny, Linden Hills, and Lynnhurst residents”.

A public hearing will be held on Thursday, March 20, 2014 by the City’s Zoning and Planning Committee at 9:30 am. That committee is chaired by Lisa Bender (Ward 10) with Vice-Chair Andrew Johnson (Ward 12).

I strongly suggest that the public attend this public hearing to voice your concern and thoughts on how this will affect the housing industry in these neighborhoods.