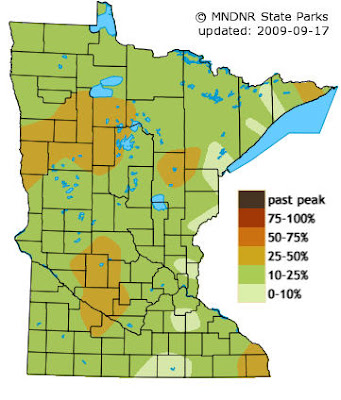

If you are looking for a place to view fall color around the state of Minnesota, a great place to check out is the Minnesota Department of Natural Resources (DNR) website. They update what is happening around the state, and give a lot of information on how/what causes the leaves to change color. Typical peak color for the Twin Cities area is Late September to Mid October.

If you are looking for a place to view fall color around the state of Minnesota, a great place to check out is the Minnesota Department of Natural Resources (DNR) website. They update what is happening around the state, and give a lot of information on how/what causes the leaves to change color. Typical peak color for the Twin Cities area is Late September to Mid October.

From the category archives:

News

Save the date to tour homes in the Twin Cities designed by licensed architects and brought to you by the AIA Minnesota chapter. Set for one weekend only, the tour is open September 19-20 from 10 am – 5 pm. Tickets are available online for $25.

This year twenty homes will be on the tour giving attendees the chance to view architectural design and how it can make the difference in a home. Thankfully, the planners have grouped the homes in a way so people can see homes that interest them:

- “City Growers” features homes in Minneapolis

- “Love of the Landscape” includes homes sensitive to the landscape surrounding them

- “Lofty Spaces” feature three lofts in Minneapolis and one in Saint Paul

- “Green Ideas”

- “Entertaining Spaces”

- “Craftsmanship” highlights details in design, woodwork and more

- “Suburban Redo” lets visitors see how a home can transform from the original design

The tour is comprised of 14 architectural firms from the Twin Cities, varying from 1-50 person offices. It is meant to show visitors the range in talent available and how architectural design can span small jobs to luxury masterpieces.

A few weeks ago, Forbes came out with their best picks for the Most Expensive Fictional Homes ever written about. That’s right, fictional homes that don’t exist.

A few weeks ago, Forbes came out with their best picks for the Most Expensive Fictional Homes ever written about. That’s right, fictional homes that don’t exist.

Russian billionaire’s purchase of French villa sets new world record for most expensive home — $750 million!

Russian billionaire’s purchase of French villa sets new world record for most expensive home — $750 million!

The market for the average priced US residence may be soft, but the über rich (especially the Russians) continue to drive prices up at the very top of the world’s luxury market. Case in point — Villa Léopolda, one of the most historic estates on the French Côte d’Azur, is now under contract by an anonymous Russian billionaire for $750 million (€500m). This three-quarters-of-a-billion dollar sales price sets a new record for the most expensive home sale in the world. The previous record was set earlier this year by Indian billionaire Laksmi Mittal, with the reported purchase of a London home for his son for about $236 million.

Villa Léopolda, a cream-colored, turreted mansion with two guest houses, is midway between Monaco and Nice overlooking Cap Ferrat, near Villefranche-sur-Mer. The villa was originally built about 1902 by King Leopold II of Belgium. The grounds are regarded as among the most spectacular on the Côte d’Azur. Fifty full-time gardeners look after 20 acres of gardens and terraces, planted with 1,200 olive, orange, lemon and cypress trees.

The property’s new owner is said to be a Russian oil oligarch but not – despite initial rumors – Roman Abramovich, the highly visible owner of Chelsea Football Club, who already owns a €100m mansion near Antibes.

According to the Nice-Matin newspaper, a contract was signed last week to transfer ownership of the villa from Lily Safra, the widow of Edmond Safra, a murdered banking billionaire. Rumor has it that Mrs. Safra held out for months as the persistent mystery buyer kept raising his offering price. The paper also reported that 60 villas or mansions on Cap Ferrat are now owned by wealthy Russians.

The property has a unique history. In 1916, King Leopold’s nephew and heir, King Albert I, turned the villa into a hospital for officers wounded during the First World War. It later passed into the hands of the Agnelli family – Fiat automotive tycoons — and became the scene for legendary jet-set parties in the 1960s, attended by Frank Sinatra, Ronald Reagan (in his acting days) and others.

“This sale raises the bar and makes the half dozen or so $100 million U.S. properties on the market seem like bargains,” said Laurie Moore-Moore, Founder of The Institute for Luxury Home Marketing, a US-based organization which trains real estate agents who work in the luxury market and awards the international Certified Luxury Home Marketing Specialist designation. “Today’s affluent are citizen’s of the world and the successful luxury agent must know how to reach them and what lifestyles they are seeking. It’s an exciting and active market for agents at the top.”

** Thanks to Sharon Simms for links to good photos of the property like this aerial shot.**

After much anticipation and a full year of home owners facing foreclosure sweating it out, H.R. 3648 – Public Law 110-142 was finally signed into law December 20, 2007.

One of the pitfalls of a short sale or foreclosure is that any debt amount forgiven or discharged by the lender is recognized as taxable income by the IRS, and then taxed at ordinary income rates for the home owner, even though no actual cash changes hands. The taxation of “fake” money was just another kick in the pants to homeowners who just lost their home to foreclosure, only to find a huge tax bill in the mail that most could not afford to pay. The Act was given a boost of support with the number of foreclosures and the mortgage/financial crisis, not to mention the decreasing home values happening across the country.

So now, with the passage of the H.R. 3648, individuals who are relieved of their obligation to pay some portion of a mortgage debt on a principal residence between January 1, 2007 and December 31, 2009 will not be required to pay income tax on any amount that is forgiven.

Here are some details that might apply to you:

- No Income Limitation: All borrowers receive the relief, no matter what their income.

- Dollar Limitation: No more than $2 million of mortgage debt is eligible for the exclusion ($1 million of debt for a married filing separately return).

- Relief applies only to an individuals principal residence and the forgiven mortgage debt must have been secured by that residence.

- No relief is available for cash-outs, whether the cash-out takes the form of a refinanced first mortgage, a second mortgage, home equity line of credit or similar arrangement.

- Eligible debt is what is called “acquisition indebtedness.” This is debt used to acquire, construct or rehabilitate a residence.

1) Refinanced debt qualifies, so long as the debt does not exceed the original amount of the debt. (Same rule as Mortgage Interest Deduction)

2) Home equity debt (or second mortgages) qualifies if the funds were used to improve the home. (Borrower must have adequate records, as under current law.)

3) See cash-outs, above. No amount of a cash-out may be treated as acquisition debt.

Here are a few points of clarification as supplied by the Minnesota Association of Realtors:

- Refinanced Mortgages: The relief does apply to refinanced debt in some circumstances. The rules seek to assure that any debt eligible for the relief is directly related to the acquisition or improvement (such as rehabilitation, expansion, renovation, reconstruction) of the principal residence. Debt used for furnishings (i.e., any movable property) in the home is not eligible for the relief. When the proceeds of any refinanced debt is used for any purpose other than acquisition or improvement, those proceeds are not eligible for the relief.

- Principal Residence: A principal residence is defined in the same manner as the rules that apply to the capital gains exclusion on the sale of a principal residence. An individual may not have more than one principal residence at any given time.

- Second Homes: As a general matter, the relief does not apply to any debt forgiveness on any mortgage for any second home of the taxpayer. However, if a taxpayer uses a residence (other than his principal residence) solely as an income-producing rental property, already-existing relief provisions might apply, depending on the taxpayer’s situation. if the second home property was acquired as a speculative investment (such as for resale rather than rental), relief provisions are unlikely to be available. In all events an individual who is in a short sale, foreclosure, workout or similar situation on a residence (including condos) other than his principal residence should consult a tax adviser to determine what, if any, relief provisions might be available.

Some other points of interest that are tacked on to the Mortgage Debt Cancellation Relief Act are the following:

Mortgage Insurance Premiums: The deduction for mortgage insurance premiums is extended through tax year 2010. Income limitations on the deduction will continue to apply.

Surviving Spouses/$500,000 Exclusion: In some circumstances, a surviving spouse is denied eligibility for the full $500,000 exclusion on the sale of his/her principal residence. This most frequently occurs when the residence is not held in joint ownership at the time the spouse who is not on the title dies. In that case, the deceased spouse had no ownership interest, so there is no basis step-up on that half of the property. the surviving spouse is thus eligible only for an exclusion of $250,000. (Had the home been sold during the deceased spouse’s lifetime, the full $500,000 exclusion would have applied, so long as they filed a joint return.) Challenges for the surviving spouse are compounded when this circumstance occurs late in the year. The surviving spouse is often unable to sell the property within the same year that the spouse died. This legislation provides that a surviving spouse may claim the full $500,000 exclusion not only in the year of the deceased spouse’s death, but also during the two years after the spouse’s death.

Second Homes Converted to Principal Residence: The original House-passed version of this legislation included a provision that would have limited the application of the $250,000/$500,000 exclusion when a second home is converted to a principal residence and later sold. Thankfully, this change was not included in the final legislation that the President signed, as it would have hurt those that own second homes with huge capital gain taxes.

In case you missed the Rose Bowl parade today which announced the four winners of the Change the World.Start at Home contest, Saint Paul has won the popular vote. Saint Paul will have three projects featured and completed in late April of 2008.

Now what they need is volunteers! If you would like to volunteer to help on one of the three projects, visit this website to offer your services. This is a fantastic opportunity for our community to show just what “Minnesota Nice” is all about!

Since the Democrats took over the Minnesota House of Representatives this year, all I keep seeing in the news is how they want to raise taxes. Let’s see, they want to add a 10 cent tax to gasoline, increase the state deed tax on home sales by 50%, and now they want to increase the income tax rate on local Minnesotans. Folks, we have a $2.2 Billion surplus in this state, so why are we increasing taxes? To play politics, plain and simple.

Local legislators want you to think they are great. The scam is to get residents to believe in the Robin Hood method, take from the “evil” rich and give that money to the poor. I am sorry, but this is NOT what America was founded on. If the House and Senate have their way, the new tax bill will go into effect in 2008, just weeks before the next election. They want the middle class public to see how “great” they have treated us by taxing the wealthy, only so we will cast our votes for them.

The House tax bill will raise the top income tax rate from 7.85% to 9%, and the Senate version would increase it to 9.7. The income generated would then be given back to non-wealthy home owners via a property tax credit. I am sure that sounds great to some, but not to me. I am not wealthy and I do not think it is correct to tax someone who works hard for their money more just “because they can afford it”. The only person who can stop the constant drafting of bills further taxing Minnesotans is the Governor, who has declared he will veto any such bill that comes across his desk. He is encouraging the Dems to come up with an alternative solution to solve their spending habits, instead of taxing the locals.

I was born and raised in Indiana, so I have Midwestern blood. It pains me to see our Midwest population move to the coasts or to places like Arizona because the cost of living is cheaper. Minnesota currently has the third highest income tax rate in the nation. If the House and Senate get their way, we will be #1. I don’t know about you, but I take better pride in being the 5th best “Green City” in the world. If I was a wealthy Minnesotan, I just might join the crowd and take my chances in Florida…they don’t have a state income tax!

Minnesota Historical Society Sells Rare Gem at Christies

When the railroad baron James J. Hill bought a diamond and sapphire necklace for his wife in 1886 for a recorded amount of $2200, he probably never thought about what the single sapphire would fetch in 2007. Well this week the rare sapphire from Kashmir fetched an auction price of just over $3 Million.

After Hill’s death in 1916, the necklace was divided up among his six surviving daughters. The single sapphire, weighing 22.26 carats, was passed down to descendants and finally bequeathed to the Minnesota Historical Society in 2006. The sale sets a world record as most expensive sapphire ever sold. Proceeds will help to maintain the historic home for years to come.

James J. Hill built the Great Northern railway, along with the Northern Pacific railway and is reported to have been one of the richest men in America of his century. He built the now famous Hill mansion at 240 Summit Avenue in St Paul, MN. The home has just undergone extensive exterior renovation and is looking reborn. The above photo was taken the first week of April 2007 by myself. Visit the Minnesota Historical Society web page for tour hours and make sure to see this historic landmark of Saint Paul.