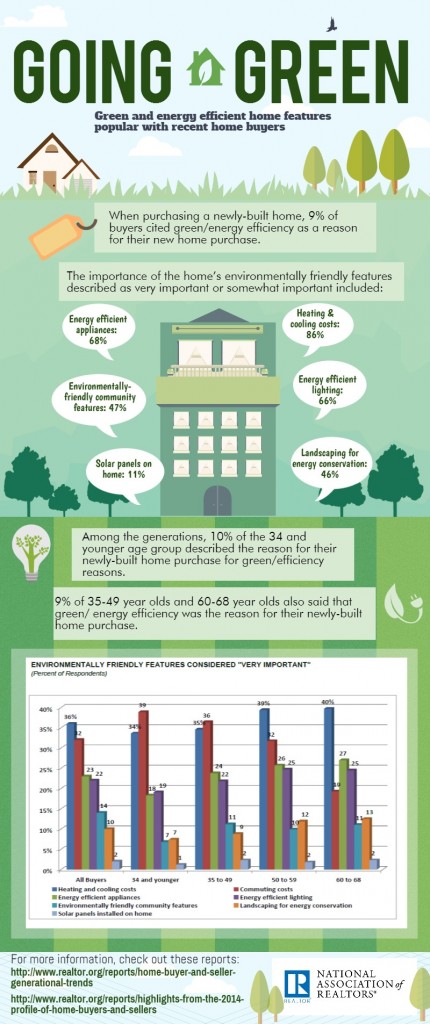

The National Association has just released some statistics about how green home features are affecting buyers decisions when purchasing a home. While commuting costs are a big concern for younger buyers, energy heating and cooling costs are the number one concern as buyers get older. Even though the data paints a broad stroke over the entire nation, it is safe to say that commuting and energy costs rank high in Minnesota, too. Local builders are taking building “green” into account, some becoming GreenStar certified.

Posts tagged as:

first home

I remember eight years ago when we bought our first home…just married, and transferring to a new city from San Diego, we had no idea what life would be like living on the Gulf Coast. Being the savvy Internet gal I was at the time (and still am), I shopped for homes on-line, narrowing down the list of homes my husband had to see when he went house hunting. (Yes, that’s right, when HE went house hunting. Unfortunately, I could not get time off work, but he received 10 days.)

There was one home in particular that caught my eye – a For Sale by Owner (FSBO in real estate speak) home that had the prettiest back yard. I called the owner right away and told her my husband would be in town in a week and set up an appointment to view the home. For days my husband viewed homes with a real estate agent, taking pictures of each, drawing up a pros/cons list, and then emailing me everything each evening so we could discuss our thoughts. He did a really good job!

The last home he saw was the FSBO. Right away he knew it was the one. See, I love to garden, and the back yard of this home was full of Gardenias, Azaleas, Oleanders, Camellias, a beautiful Magnolia tree, and my husband knew that it was “me”. It was apparent that the original owners of the home were gardeners, too, as the landscaping was fantastic. Long story short, we bought that home, and lived there for three years. I have to say that I cannot think of a better place to begin a family than that small home. It was perfect, and so you can imagine how hard it was to leave when it came time to transfer to another city.

For the last five years, every now and then, I have thought back to that home with fond memories. I have always wondered if the couple who bought the home from us took care of it the way we did – did they make sure to drink in the smell of the Gardenias as they sat on the patio late in the evening? Did they enjoy watching the different colors bloom throughout the yard? I hoped so.

Well, two weeks ago we flew back to the area to visit a dying relative and some of our old friends. Being busy as vacations are, it took us till the last day to finally drive by the old house to see what it looked like. As we drove up, I could tell right away it was no longer the house we had enjoyed. Every bush in the front yard had been pulled up and replaced with a Palm Tree. And the fragrant Viburnum that stood by the front door was gone too. Being as a road was directly behind the house, we were able to drive by and peer through the slats of the backyard fence. To my utter shock, we found that the owners had pulled up everything but the trees. ALL the beauty was now gone and it was hard to choke back the tears of sadness and disbelief.

It’s hard to return to your first home to see everything that made you fall in love with it destoyed. I am sure this does not happen to everyone, as usually most buyers improve a home and the property, but it seems to happen to me. ( The same thing happened to my childhood home, according to my brother, with the new owner pulling out everything but the trees, and I still to this day refuse to drive by it.)

What is it that makes your first home magical?

I believe it is the simple fact that after years of being taken care of by your parents, the first home purchase is all YOURS. You made it happen. Your money financed the home. It’s your piece of the American Dream. Sadly, our dreams are not always the same as someone else’s – that’s just life. But in the end, no matter what happens to the home we first bought, we will always have the fantastic memories we made in it. Those are the parts of life that really matter and the parts that no one can ever take away.