State of the Twin Cities Luxury Home Market

I thought it would be interesting to compare the current Spring real estate market for luxury homes in the Twin Cities to the last couple of years, and see if things have improved at all. The news is constantly stating that the Minnesota real estate market is roaring back to life, what with our shortage of inventory and less buyer fear, but can the same be said about the luxury market?

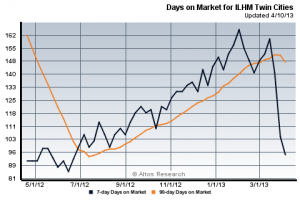

Days on the Market

Back in 2010, the rug was pulled out from under the luxury real estate market and it seemed to take forever for a home to sell. The average Days on the Market, what we real estate agents call DOM, was 212 – meaning that is took on average 212 days for a luxury home to sell.

Days on the Market 2010

Days on the Market 2010

Now, look at March 2012 and the numbers get better. The average number of days drops to 170!

Days on the Market 2012

Days on the Market 2012

For April 2013, the number drops to 148!

Days on the Market 2013

Days on the Market 2013

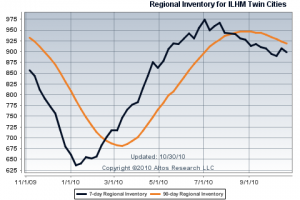

Inventory

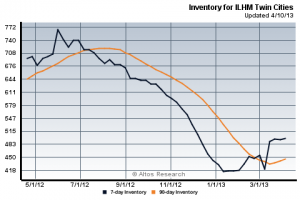

Inventory is often one of the deciding factors on how a real estate market will perform. Too much inventory and few buyers makes for a terrible market. In 2010, sellers were scared and wanted to get out of their expensive homes. Buyers however were very worried and became hesitant if not completely shut off from buying a new home. No other inventory in the Twin Cities felt this more than the luxury home market, starting at about 685 homes for sale in Spring 2010 and roaring to 925 in the Fall.

Inventory 2010

Inventory 2010

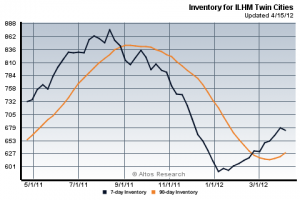

Spring 2011 started off with 653 homes on the market and increased to around 836 by September, however when Spring 2012 hit, less homes were being offered for sale – coming in at around 620.

Inventory 2012

Inventory 2012

Once Fall 2012 came around, only 708 homes were for sale. That’s a 15.3% decrease from 2011! Of course now that Spring 2013 is here, I know the market inventory is low simply by trying to find homes my clients might like. We can’t find any! That’s because there are only currently about 430 luxury homes on the market. When compared to 2010, we quickly see that the Twin Cities Spring luxury inventory has decreased by 37%!

Inventory 2013

Inventory 2013

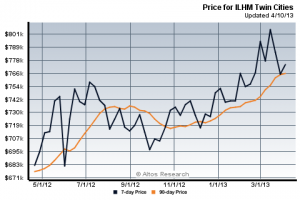

Average Price

Starting in late 2009, the luxury home market started to be affected by the economy, and prices started a slow decline over the next year. By August 2010, average prices began a rapid decline making 2011 a terrible year to sell an upper bracket home in the Twin Cities. Homes that once held a value well over $1 Million, were now selling for $700-800K. Foreclosures and short sales became more prevalent, as home owners found themselves underwater and unable to afford their castles.

Average Price 2010

Average Price 2010

By Spring 2012, home values were at their lowest, only bringing in an average of around $675,000, but every cloud has a silver lining. Over the last year, the average price of a luxury home has been steadily increasing, and we are now back at 2009 pricing.

What Does It All Mean?

Wow, what a difference a few years make! While the numbers look to tell a great story, it is still a cautious time. Home owners are not listing as many homes, thus giving buyers less choices. This helps prop up the market with homes selling quicker, but buyers are still afraid of paying too much for a home. Most of the buyers I encounter refuse to pay list price, and they also want to see the price of similar homes that have sold in the area in order to justify their offers.

The most interesting information in the report, in my opinion, is not the average price number, but the graph direction in general. Looking at 2010, the graph line is going down. But take a look at what has been happening since May 2012. The graph direction is going up, as if it is trying to claw its way out of the abyss. Let’s pray it keeps going up!