A pattern is emerging that shows a fresh willingness by sellers to put homes on the market and buyers to enter the market. New listings are on the rise, if not in year-over-year comparison, then certainly in week-over-week views, as we bounce well past the new year. A recent article in the Star Tribune confirms that sales in the Twin Cities are the best seen in the last 10 years.

Posts tagged as:

st paul

Looking for something to do this holiday? Need a little bit of color pick-me-up? Visit the Como Conservatory for a great Holiday display going on until January 4, 2015. Makes for some great photos, too!

When it comes to selling your home, honesty is always the best policy, especially when speaking with your agent.

Each time I meet with home owners to discuss their property, I let them know up front that I offer complete honesty, adding that I don’t “sugar coat things”. I’m blatantly honest to the point that I have had a few home owners get mad at me for “insulting” their home. (Some home owners don’t want to face the facts that the home needs a MAJOR cleaning.)

Of course I asked them if they would rather have an agent lie to them to get a listing, or have an agent tell them what they most likely don’t want to hear and help them get the home sold. I have yet to have someone tell me to lie.

But the main point of this story is that after I state my commitment of honesty to them, I notify them that I expect the same level of honesty from them in return. Remember, anything you tell your agent is confidential. So don’t be afraid to tell them a divorce is on the way, or that you just received a notice of foreclosure.

What ever you do, DON’T hide facts that can affect the listing.

I once had a home listed that I was heavily marketing, and putting a ton of time and money into getting it sold.. It wasn’t fun getting a call one day from a buyer’s agent asking how long my clients had been in foreclosure. This was news to me. I had specifically asked the sellers if they were in foreclosure and had been told no. I had also looked into public records, and there was no foreclosure notice posted. Of course the day it became public was the day this agent had seen it, and thus called me because he had an interested client.

When I asked the home owners why they hadn’t told me, they said it was private information and that they were embarrassed to tell me. Unfortunately, their failure at being honest cost us months on the market. Now we had to regroup and talk short sale. Time was running out, and a short sale takes time. Luckily, they had a bank that was on top of things, and we were able to get a short sale approved. Unfortunately, their lack of honesty caused unnecessary stress and loss of time for all involved.

I could go on and on with examples of how past clients have been less than honest with me, and each one has had it affect them negatively – either through more time on the market, less money earned on the sale of their home, or no sale at all. Don’t let this be you! Be HONEST with your agent because they’re there to help get your home sold, no matter what the circumstances.

Most Expensive Homes in the St. Paul Area

It’s always fun to see what the Most Expensive Homes For Sale look like, where they are located, and what price they are asking, so I thought I would update my readers and let them take a peak at these amazing homes, this time in St. Paul. Most are historic homes with some amazing architectural features that just can’t be replicated today.

View the rest of these luxury homes below:

[idx-listings linkid=”371989″ count=”10″ showlargerphotos=”true”]

If you plan on building a new luxury home in the near future, you might have an extra expense to contend with if Governor Dayton gets his way.

Currently the Minnesota Department of Labor and Industry (DLI) is processing an update to Minnesota’s Building Code. Minnesota’s code is based upon the International Residential Code (IRC), which it amends to reflect local climate and building practices. The DLI’s ongoing process to update the code has featured an intense debate over the inclusion of a fire sprinkler system mandate in Minnesota’s code update. Since 2011, state lawmakers have passed two bills that would have prevented Minnesota from mandating home sprinkler systems. Both times Governor Mark Dayton has vetoed the bills.

In late October the draft building code was released with a home indoor sprinkler system mandate for all newly built homes 4,500 sq ft (including unfinished living space) and above. Notice it includes “unfinished living space”. That means your unfinished basement square footage is included in the numbers. While it is my opinion that it actually might be a good idea to install sprinkler systems in expensive luxury homes, it is NOT a good idea for the government to mandate it. The choice should be left up to the consumer because it’s their pocket book paying for the extra expense.

Don’t get too comfortable if you see a new home in your future under 4,500 square feet. Tom Brace, executive director of the Minnesota State Fire Chiefs Association, has said in a recent article that his ultimate goal is to mandate sprinkler systems in ALL new residential homes.

If you would like to learn more about the push to prevent the mandate, check out the website sponsored by the Twin Cities Builders Association.

It’s always fun to see what the Most Expensive Homes for sale in Minnesota look like, where they are located, and what price they are asking, so I thought I would update my readers and let them take a peak at these amazing homes.

- Everyone knows the Pillsbury Mansion on Lake Minnetonka is for sale and has been on the market for some time. Originally priced at $53.5 Million, and now at $24 Million, it is to be expected that it might take awhile to find that perfect buyer. It is owned by Former Minnesota Vikings co-owner James Jundt who bought the property in 1992.

- If you are looking for a great buy, the mansion in Dellwood, owned by Dwight Opperman (listed by Forbes as one of the 400 richest Americans), has recently had its asking price cut in half, from $12 Million to $6 Million.

- Another home that has been recently reduced in price is the 78 acre estate of former strip club owner Larry Kladek in Inver Grove Heights.

- My favorite is of course my listing in Minneapolis, The Donaldson Mansion on Mount Curve Avenue. One of the most beautifully restored historic homes I have ever seen!

View the rest of these luxury homes below:

[idx-listings linkid=”324191″ count=”10″ showlargerphotos=”true”]

State of the Twin Cities Luxury Home Market

I thought it would be interesting to compare the current Spring real estate market for luxury homes in the Twin Cities to the last couple of years, and see if things have improved at all. The news is constantly stating that the Minnesota real estate market is roaring back to life, what with our shortage of inventory and less buyer fear, but can the same be said about the luxury market?

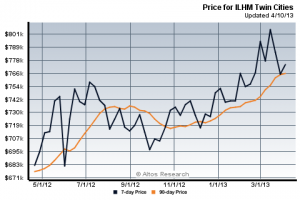

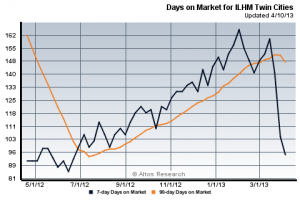

Days on the Market

Back in 2010, the rug was pulled out from under the luxury real estate market and it seemed to take forever for a home to sell. The average Days on the Market, what we real estate agents call DOM, was 212 – meaning that is took on average 212 days for a luxury home to sell.

Days on the Market 2010

Days on the Market 2010

Now, look at March 2012 and the numbers get better. The average number of days drops to 170!

Days on the Market 2012

Days on the Market 2012

For April 2013, the number drops to 148!

Days on the Market 2013

Days on the Market 2013

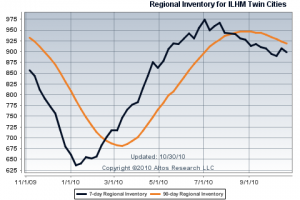

Inventory

Inventory is often one of the deciding factors on how a real estate market will perform. Too much inventory and few buyers makes for a terrible market. In 2010, sellers were scared and wanted to get out of their expensive homes. Buyers however were very worried and became hesitant if not completely shut off from buying a new home. No other inventory in the Twin Cities felt this more than the luxury home market, starting at about 685 homes for sale in Spring 2010 and roaring to 925 in the Fall.

Inventory 2010

Inventory 2010

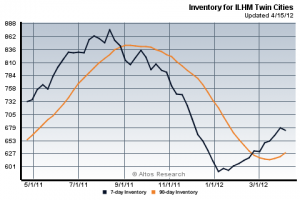

Spring 2011 started off with 653 homes on the market and increased to around 836 by September, however when Spring 2012 hit, less homes were being offered for sale – coming in at around 620.

Inventory 2012

Inventory 2012

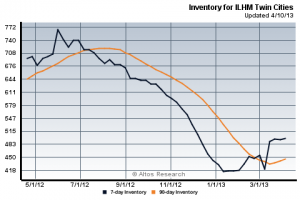

Once Fall 2012 came around, only 708 homes were for sale. That’s a 15.3% decrease from 2011! Of course now that Spring 2013 is here, I know the market inventory is low simply by trying to find homes my clients might like. We can’t find any! That’s because there are only currently about 430 luxury homes on the market. When compared to 2010, we quickly see that the Twin Cities Spring luxury inventory has decreased by 37%!

Inventory 2013

Inventory 2013

Average Price

Starting in late 2009, the luxury home market started to be affected by the economy, and prices started a slow decline over the next year. By August 2010, average prices began a rapid decline making 2011 a terrible year to sell an upper bracket home in the Twin Cities. Homes that once held a value well over $1 Million, were now selling for $700-800K. Foreclosures and short sales became more prevalent, as home owners found themselves underwater and unable to afford their castles.

Average Price 2010

Average Price 2010

By Spring 2012, home values were at their lowest, only bringing in an average of around $675,000, but every cloud has a silver lining. Over the last year, the average price of a luxury home has been steadily increasing, and we are now back at 2009 pricing.

What Does It All Mean?

Wow, what a difference a few years make! While the numbers look to tell a great story, it is still a cautious time. Home owners are not listing as many homes, thus giving buyers less choices. This helps prop up the market with homes selling quicker, but buyers are still afraid of paying too much for a home. Most of the buyers I encounter refuse to pay list price, and they also want to see the price of similar homes that have sold in the area in order to justify their offers.

The most interesting information in the report, in my opinion, is not the average price number, but the graph direction in general. Looking at 2010, the graph line is going down. But take a look at what has been happening since May 2012. The graph direction is going up, as if it is trying to claw its way out of the abyss. Let’s pray it keeps going up!