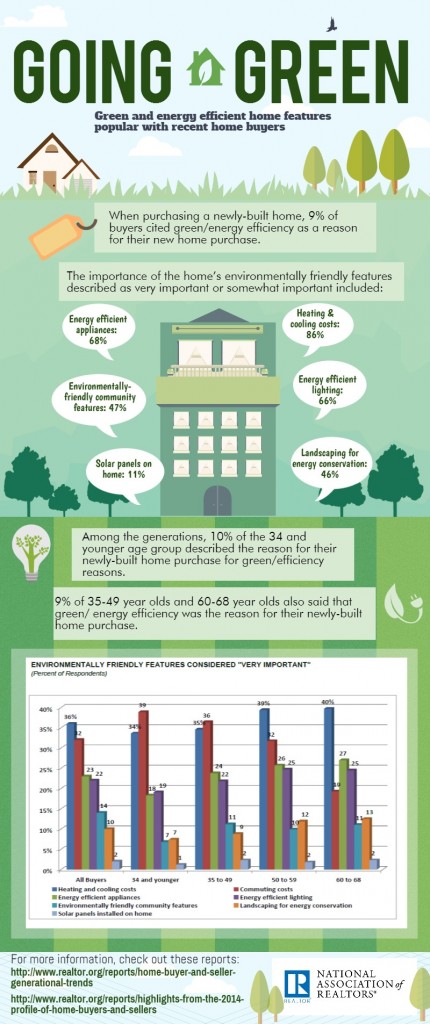

The National Association has just released some statistics about how green home features are affecting buyers decisions when purchasing a home. While commuting costs are a big concern for younger buyers, energy heating and cooling costs are the number one concern as buyers get older. Even though the data paints a broad stroke over the entire nation, it is safe to say that commuting and energy costs rank high in Minnesota, too. Local builders are taking building “green” into account, some becoming GreenStar certified.

From the category archives:

News

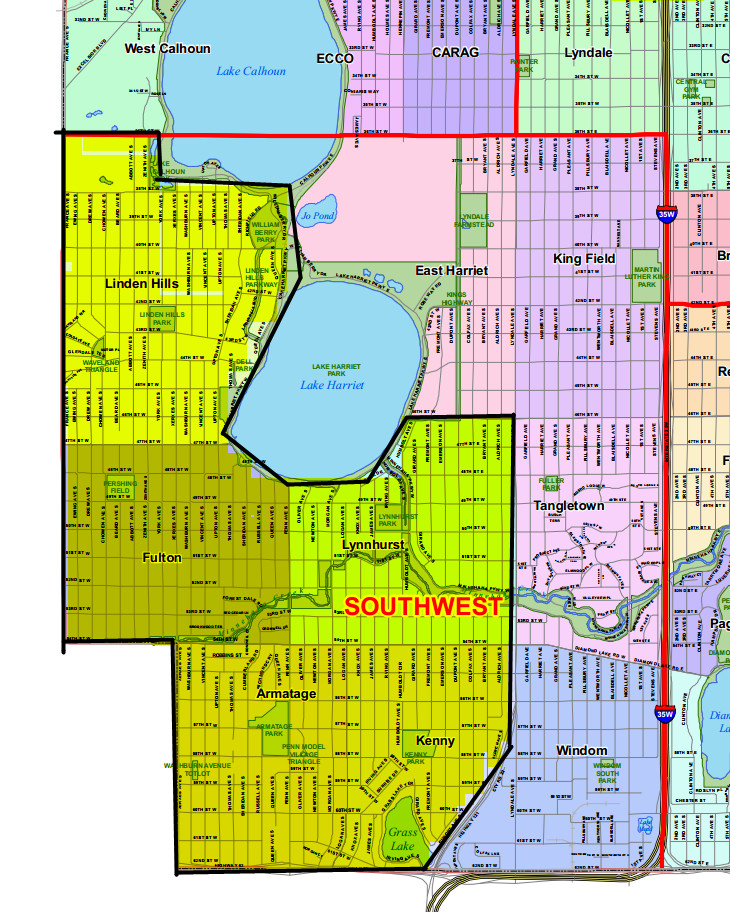

On Friday, March 7, 2014, the Minneapolis City Council voted 13-0 to immediately enact a moratorium on residential redevelopment in the Armatage, Fulton, Kenny, Linden Hills, and Lynnhurst neighborhoods. This action was brought by newly elected Ward 13 Councilmember Linea Palmisano, and will last for ONE YEAR!

Highlighted Neighborhoods of Minneapolis Moratorium

This means if you are looking for new construction in these neighborhoods, you can’t build. If you want to sell your home to a developer as a tear down, you can’t because the developer won’t buy it. If you were thinking of adding on an addition to your home, you can’t do it unless the total above ground square footage is less than 1500. Oh, and if you are having a hardship, you have to appeal to the City Council and prove your hardship…if it isn’t good enough for the council, than you will be denied!

Is this stupid??? Ummm, YES!

The official council motion reads:

Motion by Palmisano to introduce an ordinance amending Title 21 of the Minneapolis Code of Ordinances relating to Interim Ordinances, for first reading and referral to the Zoning & Planning Committee (adding a new Chapter 590 providing for a moratorium on the demolition, new construction, or establishment of single and two-family residential dwellings in the R1, R1A, R2, and R2B zoning districts in neighborhoods of Linden Hills, Fulton, Armatage, Kenny, and Lynnhurst, and authorizing the department of Community Planning and Economic Development to conduct a study to inform future development of the area and to propose such amendments to the city’s official controls and other regulatory devices)

The full text of the ordinance can be found here.

Due to the invocation of the city’s Zoning Code Chapter 529, the council was able to make this ordinance effective immediately upon passage.

According to the Minneapolis Association of Realtors, “neither the housing industry nor the public was invited to engage with the city on any issues of concern leading up to this moratorium vote. We are very disappointed that the City moved to put a yearlong ban on housing in these critical Minneapolis neighborhoods. The disregard for constituents, both current and future, saddens and dismays all of us in the housing community. This moratorium will be incredibly damaging the overall housing market, and especially to the property rights of Armatage, Fulton, Kenny, Linden Hills, and Lynnhurst residents”.

A public hearing will be held on Thursday, March 20, 2014 by the City’s Zoning and Planning Committee at 9:30 am. That committee is chaired by Lisa Bender (Ward 10) with Vice-Chair Andrew Johnson (Ward 12).

I strongly suggest that the public attend this public hearing to voice your concern and thoughts on how this will affect the housing industry in these neighborhoods.

If you plan on building a new luxury home in the near future, you might have an extra expense to contend with if Governor Dayton gets his way.

Currently the Minnesota Department of Labor and Industry (DLI) is processing an update to Minnesota’s Building Code. Minnesota’s code is based upon the International Residential Code (IRC), which it amends to reflect local climate and building practices. The DLI’s ongoing process to update the code has featured an intense debate over the inclusion of a fire sprinkler system mandate in Minnesota’s code update. Since 2011, state lawmakers have passed two bills that would have prevented Minnesota from mandating home sprinkler systems. Both times Governor Mark Dayton has vetoed the bills.

In late October the draft building code was released with a home indoor sprinkler system mandate for all newly built homes 4,500 sq ft (including unfinished living space) and above. Notice it includes “unfinished living space”. That means your unfinished basement square footage is included in the numbers. While it is my opinion that it actually might be a good idea to install sprinkler systems in expensive luxury homes, it is NOT a good idea for the government to mandate it. The choice should be left up to the consumer because it’s their pocket book paying for the extra expense.

Don’t get too comfortable if you see a new home in your future under 4,500 square feet. Tom Brace, executive director of the Minnesota State Fire Chiefs Association, has said in a recent article that his ultimate goal is to mandate sprinkler systems in ALL new residential homes.

If you would like to learn more about the push to prevent the mandate, check out the website sponsored by the Twin Cities Builders Association.

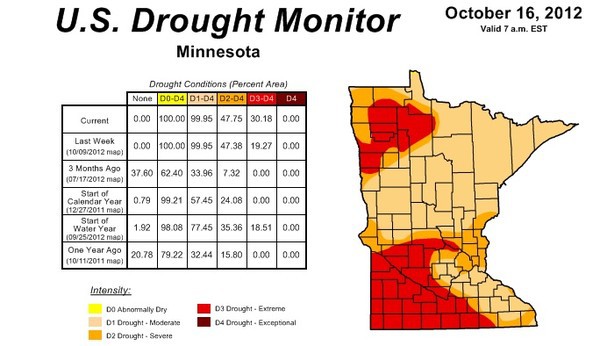

It looks like the lack of rain is taking its toll on Minnesota lakes and rivers. According to the state climatology office, the last three months near zero precipitation is making most of Minnesota rainfall totals rank at or below the lowest on record. The DNR is also calling for water conservation across the state and is giving examples of how the drought conditions are affecting the State’s water levels:

It looks like the lack of rain is taking its toll on Minnesota lakes and rivers. According to the state climatology office, the last three months near zero precipitation is making most of Minnesota rainfall totals rank at or below the lowest on record. The DNR is also calling for water conservation across the state and is giving examples of how the drought conditions are affecting the State’s water levels:

- Water conflicts between users and uses are emerging in more places.

- Nearly one-half of the state is in severe drought or worse; severe drought is considered a one in 10-year event; extreme drought is considered a one in 20-year event.

- The extent and geographic distribution of the current drought is rivaling the extreme drought event of the late 1980s.

- Large areas of Minnesota have missed the equivalent of two summertime month’s worth of rain.

- Soil moisture levels are at or below all-time low values for the end of September.

- White Bear Lake’s water level has hit its lowest point on record.

- It is a dire situation going into the 2013 growing season.

For Lake Minnetonka, the current water level is a foot lower than it was a few months ago, and about 18 inches lower than at the beginning of summer, according to the DNR and an article from the Lake Minnetonka Patch. The lowest recorded water level ever recorded for Lake Minnetonka was in 1937, putting it about 6 feet lower than the recent October 2012 measurement.

You might wonder why Lake Minnetonka water levels might matter so much to the Twin Cities. The answer is simple – it is the beginning of the Minnehaha Creek watershed which encompasses “181 square miles that drain into the Minnehaha Creek and ultimately the Mississippi River. The watershed includes Minnehaha Creek, Lake Minnetonka, the Minneapolis Chain of Lakes, and Minnehaha Falls and there are eight major creeks, 129 lakes, and thousands of wetlands” affected by decreasing water levels. Low levels in the watershed mean a low Mississippi River, which can already be seen in areas down to the Gulf of Mexico.

While levels are not at record lows, it is a concern for the upcoming years if we don’t get rain soon. If the winter brings no snow, conditions will only worsen in the spring and make for a very dry 2013. Maybe it’s time to start the rain dance.

Looks like the Grand Hotel in downtown Minneapolis has sold for $33 million to Pebblebrook Hotel Trust. According to Business Wire, the new owner plans on investing $4.5 million into building renovations. The building will continue as a top luxury hotel for Minneapolis.

The building was originally opened in 1915 as the Minneapolis Athletic Club, built by Bertrand and Chamberlin. Its short stature of 12 stories can be attributed to a 1920’s height restriction.

While most of us that live in the Twin Cities know that the first place we think of to find high end goods is Edina’s Galleria, the Mall of America, or MOA to us locals, is revamping its style to include some luxury brands previously only reserved for the West side. For those of us that now cringe to travel to the Galleria because traffic is just so dog gone annoying, we can now take a detour to the shops at MOA.

The “South Wing” of the mall is getting a face lift to draw in high-end brands, including porcelain tile and crystal chandeliers, all to a luxury price of $5 Million. Current tenants include Burberry, Hugo Boss, Betsey Johnson, Nordstrom, with more to come in the upcoming months. The true test of keeping these brands here will be sale driven, as rent in MOA is pretty high. Only time will tell if true Lux can survive in Bloomington, the shopping ugly step child of beloved Edina.

by Lisa Wells

National Market News:

This week the Treasury will auction $84 Billion in new debt supply, starting today at 1pm, with $10 Billion in 10-Year TIP today. If the auction doesn’t attract an appetite for the supply being offered, the Treasury would have to raise the yields on the Notes to attract buyers. And if that plays out, there would be some selling pressure on the entire Bond market, much like we saw a couple of weeks ago after poor auction results.

Also stirring the rumor mill is that St. Louis Fed President James “Raging” Bullard, stated at a conference in Shanghai, that the Fed should keep the Mortgage Backed Securities Purchase Program open beyond the end of March expiration. He went on to say that there is some interest in among other Fed Members to extend the program and that the Fed will be discussing the issue at a meeting later this month. It would be great to hear clear comments from Bernanke only because these statements appear to be the opposite of what the Fed had officially stated at each of the last two meetings-where they clearly stated the program would end. The worse case would be to have these rumors and headlines continue to confuse the market, build hope, but then have nothing materialize. This would cause a great deal of borrowers missing the great opportunity they CURRENTLY have.

30 year fixed-5.125%-5.375%….APR Range-5.254%-5.587%

15 year fixed-4.375%-4.625%….APR Range-4.503%-4.81%

5 year ARM-4.0%-4.25%%…APR Range-3.487%-3.845%

30 year fixed-4.875%-5.125%…APR Range-5.587%-5.73%

5 year ARM-4.125%-4.375%..APR Range-3.77%-4.002%

30 year fixed- 7.625%-7.875%…..APR Range-7.772%-8.313%

5 year ARM-5.375%-5.625% ..APR Range-4.909%-5.284%

Forbes.com has given the Metro area of Minneapolis and St. Paul the title of America’s Safest City, chosen because it has the lowest rates of violent crime, workplace deaths, fatal crashes and natural disasters. According to the article, Minneapolis and Saint Paul are “also one of America’s best places to live cheaply and offers easy access to some of the most scenic drives in the country“. View the other Metro areas that make the list.

Forbes.com has given the Metro area of Minneapolis and St. Paul the title of America’s Safest City, chosen because it has the lowest rates of violent crime, workplace deaths, fatal crashes and natural disasters. According to the article, Minneapolis and Saint Paul are “also one of America’s best places to live cheaply and offers easy access to some of the most scenic drives in the country“. View the other Metro areas that make the list.

You would think that in one of the “worst markets” we have seen in a long time that there would be no way a record sale could ever happen in Minneapolis. Well, like I have said numerous times on my blog, the high end market marches to a different drummer.

Back in March, I reported that 2427 E Lake of the Isles Parkway in Minneapolis was on the market with Sky Sotheby’s Realty for a whopping $5.5 Million. Well two days ago it hit the MLS as SOLD, and at a record price of $4.859 Million, making it the highest priced home to ever sell in Minneapolis.